net45 payment terms|payment terms 30 days : Clark Hence, a net 45 payment term means the buyer receives 45 additional days past the standard Net Terms before starting to accumulate interest on their purchase . Never Tell Me The Odds! . Y’know that one cutscene from the smash bros brawl: sub space emissary where you see bowser’s minions driving off with donkey kong’s banana stash? Because that’s what this video is reminding me of . Technically, lower odds means greater chance, but people have merged the two so they operating in the same .

net45 payment terms,Net 45 is a credit term, meaning invoice payment to a vendor is due within 45 days. Net 45 is slightly better for customers than typical net 30 payment terms because it offers them 15 more days to pay the bill. If a purchase order or other contract is used, the document will .

Hence, a net 45 payment term means the buyer receives 45 additional days past the standard Net Terms before starting to accumulate interest on their purchase .

Key facts. Net 45 Definition: Net 45 payment terms indicate payment is due 45 days after delivery of goods or services. Benefits of Net 45: Net 45 offers flexibility to customers, . In simple terms, net 45 means a buyer has 45 days from the invoice issue date to make the full payment. This time period is obviously a bit longer than the .

Net 45 payment term indicates the number of 45 days that are available to the client to pay for the goods or services that have been rendered by the supplier. Understanding Net . Net 45 payment terms, an essential aspect of economic transactions, establish the timescale for a corporation to pay for products or services after receipt. . A net 45 payment is a phrase that refers to an invoice that a customer must pay within 45 days. Depending on the industry, product or service and relationship . A net payment term is the agreed-upon period in which a buyer has to pay an invoice to a seller for goods or services they’ve provided. Net payment terms come with .

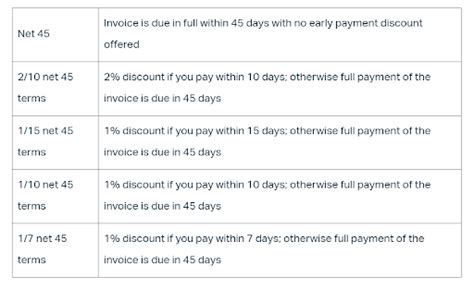

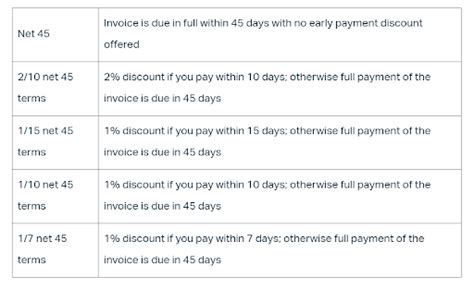

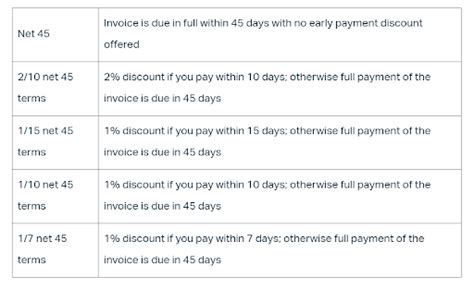

Net payment terms are when you offer your customers a fixed amount of time to pay you back. The most common terms offered are Net 30, or in other words, offering your customers 30 days to pay their . Payment terms are an agreement that outlines how, when, and by what method your customers or clients provide payment to your business. When you're running a business, it's critical that payments .A net 45 payment is a phrase that refers to an invoice that a customer must pay within 45 days. Depending on the industry, product or service and relationship between the biller and recipient, invoice payment terms can vary. Requiring payment within 45 days, as is true in a net 45 day payment invoice, is a relatively common invoice payment term.Net 15/30/60/90 represents the time before the invoice is due. So, for example, Net 15 means that the deadline is 15 days after the invoice is sent, and so on. Discount terms are net terms in which the business will provide an early payment discount if the invoice is paid before the deadline. End-of-month terms indicate that payment is due . A net payment term is the agreed-upon period in which a buyer has to pay an invoice to a seller for goods or services they’ve provided. Net payment terms come with a number – generally 30, 60, or 90, but sometimes as high as 180 – which refers to the amount of days the buyer has to pay up. . Net 7/net 45/net 90: payment is due within 7 . The company is still required to pay the full sum of the invoice, just 30 days after the invoice is received by the company, providing the customer greater flexibility. Common Net Terms are: Net 15, Net 30, Net 45, and Net 60. Tip: We find that by using the word “days” instead of “net” on the invoice customers are more likely to pay .付款条件Payment Terms. 发票是企业向客户提供服务或产品的交易记录,并附上应付金额。. 发票文件通过使用所谓的付款条件来说明销售的成本和条件。. 这些条件概述了买方必须遵循的付款流程,以便向卖方支付相应的费用。. 那么,企业发票的付款条件中应该 .

net45 payment terms payment terms 30 days Net 7, Net 15, Net 30, Net 45, Net 60. Using payment terms on your invoices is nothing new. Most businesses that offer payment terms to their customers offer Net 10, Net 30, Net 60 terms, or a .

Types of Invoice Payment Terms. A number of payment terms should be included on any invoice sent to a customer. A complete set of terms is needed to clarify the payment situation for the customer, thereby increasing your odds of being paid. The key invoice payment terms are as follows: Invoice date. This is the date on which the .

Net 30 is standard practice in many industries. If you require faster payment, swap “net 30” for “net 15” or even “net 10.”. To incentivize faster payments net terms are combined with a discount. For example: Terms: 5% 10 net 30. If you pay within 10 days, we’ll discount this invoice 5%, or you can pay the full amount due within .

Definition. Payment In Advance. This term informs the customer that they must pay the invoice amount due before the service is carried out or goods delivered. Payment in Advance could be specified for the full or partial invoice amount. Can also be called "Cash in Advance" or "Cash Before Delivery". Cash On Delivery.The most common payment terms are net 30 and net 45, which mean the buyer has 30 or 45 days, respectively, to pay the full amount. But what are the benefits and risks of switching from net 30 to .

terms of payment Net 30 days介绍:. 付款的条件为满30天供应商到货后同时开出发票、采购商才付款。. 简而言之就是货到付款. terms of payment T/T 30 days介绍:. 付款条件为收到货物的30天后电汇付款。. 简而言之就是先款后货. 扩展资料:. 1. 国际贸易支付方式是国 .In the next phase of this project, the team will notify remaining eligible suppliers that their Payment Terms will change to Net 45 in September 2021. Suppliers will be notified by July 2021. This effort will align Yale’s Supplier Database with General Payment Policy 3401, Section 3401.3. Net payment terms are when you offer your customers a fixed amount of time to pay you back. The most common terms offered are Net 30, or in other words, offering your customers 30 days to pay their invoices. Although terms aren’t restricted to Net 30. Net 60 and Net 90 are also common, as are Net 45 and Net 75.

net45 payment terms What you are looking for is Net D – a payment term, that refers to the period (10, 15, 30, 45 or 60 days) within which a customer has to pay for their outstanding invoice (net amount) for the service/product received. This might look like a small thing to you, but this could mean everything to your customers. 查阅好多资料,也无法找到NET payment 的来源, 经过多方考察,NET PAYMENT 一般都是美国和英国在使用,其他国家基本不使用。 下面我们详细讲一下NET payment的解释。 比较常见的net条款,一般是NET 7, NET 14, NET 15 或者NET 30。 NET 7 的标准翻译为: Payment of the net amount outstanding on the invoice is due seven .

1) Invoice Wording. It is important to come across as polite and professional while wording your invoice. Friendly phrases like Please make the payment on time , Kindly pay your invoice within XX days and Thank you for availing our service can increase the payment probability by more than 5 per cent.

Some allow as few as seven days or as many as 180 days. The most common net terms are Net 30 (30 days until full payment is due), Net 60 (60 days until full payment is due), and Net 90 (90 days until full payment is due). It’s important that businesses check the payment terms of a trade credit agreement and ensure that this allows them enough .

net45 payment terms|payment terms 30 days

PH0 · payment terms 30 days

PH1 · net 90 days

PH2 · net 30 days payment terms

PH3 · Iba pa

PH4 · 60 days due net